How To Buy The Dip

Is now a great time to buy? Or a terrible one?

1

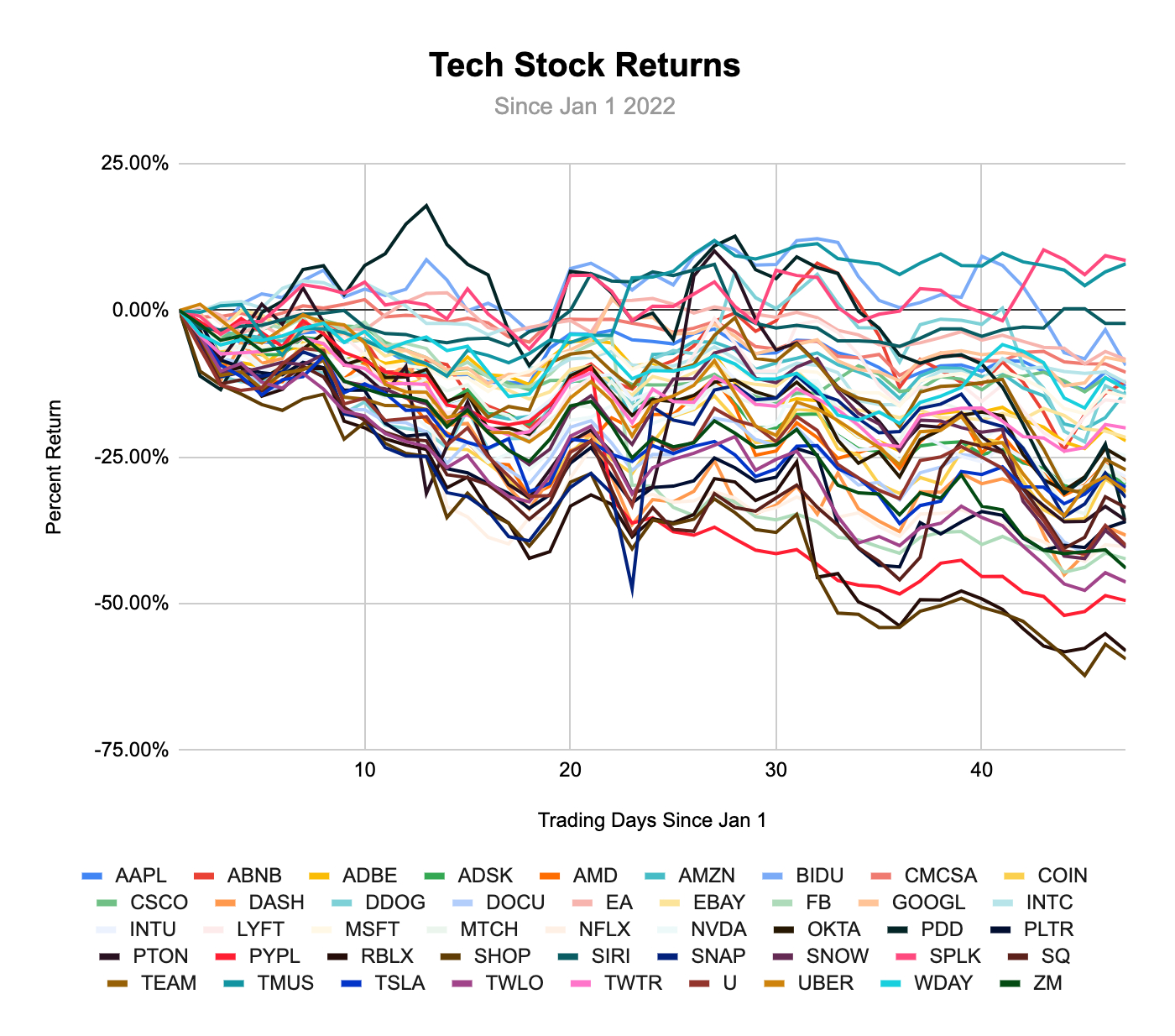

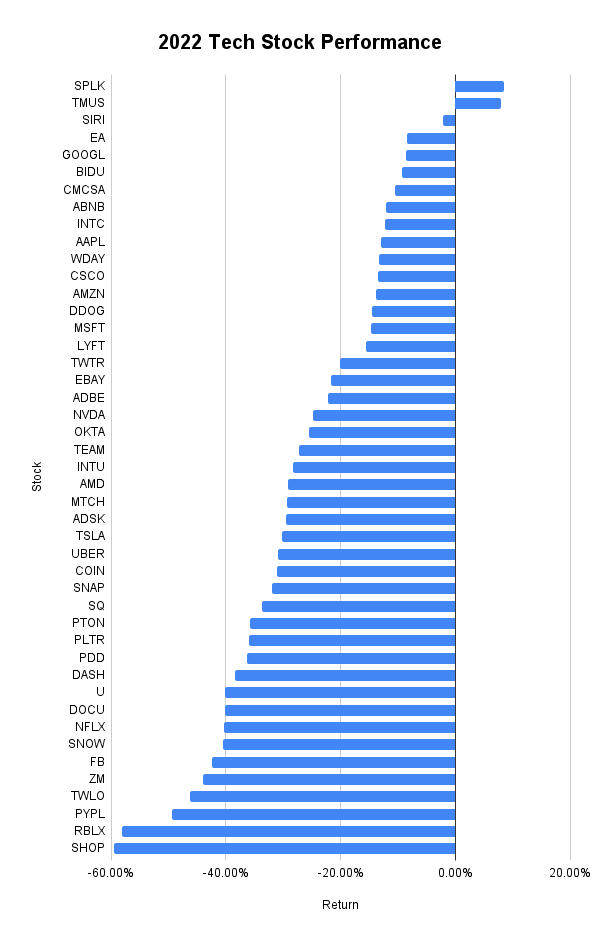

Warren Buffet once said, “you only learn who has been swimming naked when the tide goes out”—except right now the tide is going out and pretty much everybody is getting hammered:

And sure, some companies have lost more value than others, but do you really think the list below is a rank ordering of the long-term potential of these companies, best to worst?

Are the companies at the top obviously going to generate superior long-run returns to the companies at the bottom? I think not. I think there are probably a couple generational companies towards the bottom, and some real stinkers towards the top.

So maybe when the tide goes out you don’t actually get to see who has their swimming trunks on. Maybe the only way to know for sure is to wait it out and see who stands the test of time. But that doesn’t help us make investing decisions today.

What does? Understanding how market power works, and who has it.

2

If you’re thinking about investing in a stock that is going down, you’d better understand why before you buy. Is it because the company is losing power? Or is there something else going on?

Across the board, tech stocks are down right now, and there are two dominant narratives to explain it:

The first narrative is the bull case, which says we’re living in an era when generation-defining technology companies are being built, and the only reason the market is down now is because of temporary macro issues like rising interest rates, oil prices, inflation, and geopolitical instability. The companies themselves are as powerful as ever. If history is any guide, these macro issues will resolve themselves (or at least stop affecting stock prices) sooner or later. Just look at the flash recession that happened at the beginning of COVID, the 2008 crisis, the dot-com bust, etc. Sooner or later the market has always gotten back on track. So now is a great time to buy if you’re planning on holding for the long-run.

The second narrative is the bear case, which says the past few years have seen unprecedented rise in valuation multiples for tech stocks and what’s happening now is partially influenced by macro issues, but also, more importantly, a return to normalcy and sanity. Pandemic darlings like Zoom and Peloton have crashed back to earth, Snowflake is melting down, and the much-anticipated Tesla drawdown has perhaps begun. There’s a similar story behind many of the tech stocks I listed in the charts above. These companies all once sported wild revenue multiples (anywhere from 10x to the truly flabbergasting 100x) and you don’t even wanna know about the P/E ratio, since many of these companies aren’t profitable yet. Historically, these prices aren’t normal, and the current macro environment merely facilitated the inevitable return to sanity.

I subscribe to a third narrative: yes, we’re living in an era when generation-defining technology companies are being built, and yes, the main reason the market is down right now is because of temporary macro issues—but also—there are a lot of technology companies that seem generational now but will actually experience catastrophic losses in value that they will never recover from. This is not dependent on a quirk of the recent history of tech valuations. This is just the way of the world.

You might think public companies are stable and safe bets, but they’re much less stable than you might think. According to a report by JP Morgan, nearly half (44%) of the companies that have been added to the Russell 3000 (basically an extended version of the S&P 500) lost 70% or more of their value and never recovered, and just 7% of the companies generated nearly all the returns. That’s not as different from VC math as I would have expected!

This suggests two strategies for meeting the current moment:

First, buy an index fund that’s weighted towards the biggest companies. You’ll automatically get exposure to the big winners without needing to know who they are ahead of time, and the failures will automatically get cycled out without you needing to do anything. This is the easiest and safest bet.

But if you want to do your own research and make a more concentrated long-run bet on individual companies, it’s better to pick companies you know a lot about than it is to blindly buy all the hyped (read: expensive) tech companies people are talking about today. Unlike an actual index fund, you’ll need to exit these positions manually. And if history is any guide, there are going to be a lot of losers in that portfolio over the long run.

So the question remains: how can you tell which companies are likely to keep compounding value over a long period of time, and which will fade? Again I say: understanding how market power works, and who has it.

3

“The first principle is that you must not fool yourself, and you are the easiest person to fool.” Richard Feynman gave this advice to scientists trying to discover the nature of physics, but it applies equally if not more so to investors.

We get excited by stories about how companies have a moat, a network effect, a flywheel, etc—but rarely do we think through the underlying mechanisms that support those stories and ask ourselves if they are really true. We skip this step because it’s hard to do. It’s time-consuming, requires data analysis and theoretical understanding, and we won’t know if we’re right for a long time. Even then, unless we write down our thesis and revisit it, we won’t know if we were right or just lucky.

But, hard as it may be, I think it’s possible to see power clearly. That’s why I write Divinations.

My current process goes something like this:

- Start by deeply understanding the fundamental frameworks that apply to all businesses across all industries and eras. My favorites are Porter’s Five Forces, Christensen’s conservation of attractive profits, and Helmer’s Seven Powers. It’s also important to understand how companies are valued in the first place.

- As you’re learning the fundamentals, pick some businesses that are fascinating to you and learn everything you can about them. Ideally this should be an industry you’re actually working in, or want to work in. Think about how the developments you see either fit or don’t with the fundamental frameworks.

- Write about what you learn, and publish your analysis. (If you’d like to publish with Every, say hi!) People will give you feedback that makes you smarter, and you’ll be able to revisit your thinking in the future and learn from yourself. Also, writing is the best, if not the only, way to truly understand something.

- Invest progressively larger amounts of money in the businesses that you believe in. Thanks to fractional buying, this is easier than ever for investors with treasuries of all sizes. Experience the horror of a 50% drawdown, and the joy of an unexpected surge. Sit with your emotions and observe them. Before you make any decisions, do a bit of writing and consider if you are making a classic mistake, like panic-selling or FOMO-buying.

- Keep going. Develop your own investing philosophy. When opportunities come like the one we’re experiencing today, you’ll be in a much better position to buy intelligently. But remember this is a game of long-term compounding, and it’s foolish to try too hard to time the market. You can never know what it will look like next week, or next month.

Bottom line: if you already have a well-developed thesis based on the long-run durability of some specific businesses, then now seems to me like a great time to buy more. If not, now is a great time to buy index funds and maybe start your journey by putting a little bit into specific companies and learning as much as you can.*

*I could be wrong, only invest money you can afford to lose, this is not investing advice, do your own research, etc etc 😅

Comments

Don't have an account? Sign up!